Average deductions from paycheck

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. As of 2015 FICA taxes for Social Security take 62 percent of your salary up to 118500.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The result is that the FICA taxes you pay are.

. Generally employers may deduct from an employees paycheck one-half the Medical Aid Fund portion of the workers. If you receive employment income or any other type of income your employer or payer will deduct income tax at source from the amount paid. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

The deduction data is from the IRS Statistics of Income Bulletin. No matter which state you work in you need to pay FICA taxes. Make Your Payroll Effortless and Focus on What really Matters.

FICA taxes are made up of Social Security and Medicare taxes. If you leave your. Find Fresh Content Updated Daily For Standard payroll deductions.

For example an employee with a. How Much Tax Is Deducted From A 1000 Paycheck. For instance if you get paid bi-weekly and are a full-time hourly.

Estimate your federal income tax withholding. They must only take 25 one week and then make another deduction from your next pay cheque for 25. Your employer can take 10 of your gross earnings which is 25.

This will help determine your withholding when completing a W-4. The first table includes numbers reflecting the national average and the second table shows the average. If your monthly paycheck is 6000 372 goes to Social Security and.

Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. Retroactive paycheck deductions of workers compensation premiums. Ad Choose From the Best Paycheck Companies Tailored To Your Needs.

Use this tool to. These percentages are deducted from an employees gross pay for each paycheck. Your employer or payer will calculate how much.

Your employer pays another 62 percent on your behalf. Gross pay is the total earning before any deductions. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2022.

See how your refund take-home pay or tax due are affected by withholding amount. Ad Compare 5 Best Payroll Services Find the Best Rates. For 2022 employers can use a.

Simplify Your Day-to-Day With The Best Payroll Services. How Your Mississippi Paycheck Works. For Medicare you both pay.

You pay the tax on only the first 147000 of your. The paycheck you take home may be further reduced if you contribute funds toward a health or life insurance plan that your employer sponsors as any premiums you pay will be deducted.

Average U S Income Tax Rate By Income Percentile 2019 Statista

Why I Use The 50 30 20 Formula Budgeting Money Saving Money Budgeting

Get More Money On Your Paycheck Now 12 2020 Youtube Tax Deductions Savings Account Budget Planner

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Pin On Free Salary Slip Template

Understanding Your Paycheck Credit Com

Saltmoney Org Scholarship Infographic Https Www Saltmoney Org Content Media Infographic Are Schol Scholarships For College Scholarships School Scholarship

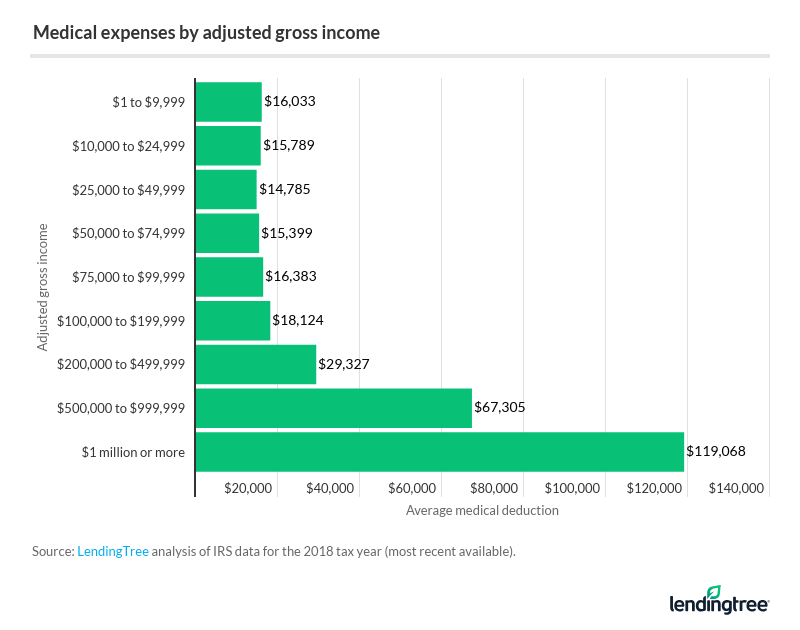

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

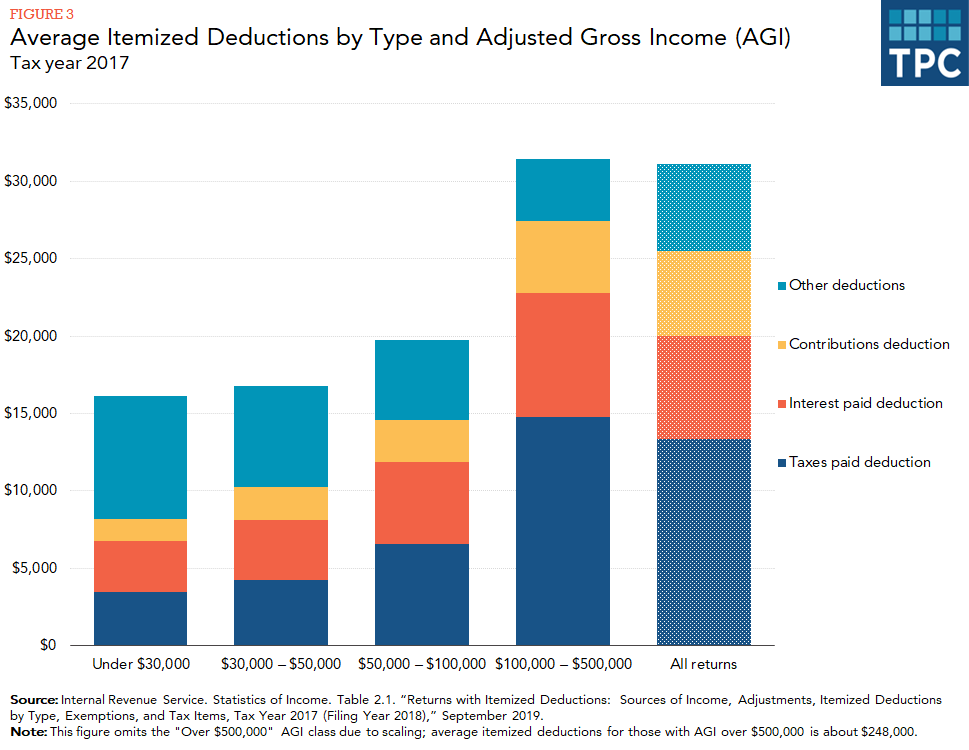

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Pin On Ideas

Only One Out Of Three Americans Actually Knows What Their Monthly Budget Is Why Is This Important If You Always Worry Spending Money Spending Habits Spending

Pin On Innes Tax Resources

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

After Tax Salary Comparably

Mary Kay Marketing Plan Sheet Perfect For Team Building Opportunities Find It Only At Www Thepinkbubble Mary Kay Marketing Mary Kay Business Selling Mary Kay

How Progressive Is The Us Tax System Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center